Asigură-te

că ai instalat

deja

aplicația de

mobile

banking

Attention to the new typology of spoofing fraud, which involves the fraudulent use of phone numbers associated with BRD. People who claim to be employees of the bank falsify, with the help of some software, the phone numbers associated with BRD (eg: TelVerde or card emergency numbers), during phone calls in which personal or confidential data is requested. It is important not to comply with requests to disclose confidential data, regardless of the pretext used by the caller. Stay alert and report suspicious situations to us immediately by accessing the MyBRD Contact service.

×Online trading

Other services

News

News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Scene 9

is an online cultural publication that shapes the portrait of the new generation of creators

Scoala 9

is an editorial project dedicated to the pre-university education created by DoR and BRD

Our team

Subsidiaries and associated entities

Culture

We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Education

We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Sports

We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Environment

Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

The Civil Society

Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Financial Information

Depository services

Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Issuer services

Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Global and local custody services

Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Clearing services

Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Contact

Discover

Learn

Apply

Saving and investments

Saving and investments

Offers

SMS banking

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Useful

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Find out more »Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Find out more »Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Find out more »Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Find out more »Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Find out more »News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Find out more »is an online cultural publication that shapes the portrait of the new generation of creators

Find out more »is an editorial project dedicated to the pre-university education created by DoR and BRD

Find out more »Find here our mass media contacts

Find out more »We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Find out more »We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Find out more »We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Find out more »Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

Find out more »Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Find out more »10 Feb 2022

Main commercial trends and financial indicators of BRD Groupe Société Générale at December 31, 2021 at consolidated level, according to the International Financial Reporting Standards (IFRS):

- Intense lending activity

- Further consolidated and diversified saving base

- Strategic milestones reached on digital roadmap

- Excellent financial performance

- Consistent dividend policy

“2021 was a year of economic rebound fostered by better business conditions and sentiment, while the National Recovery and Resilience Plan, with first amounts already disbursed, should be a catalyst for further economic growth.

Within an improved context, our commercial activity was excellent across the board. Lending activity was intense, while the savings dynamic was marked by increasing volume and higher diversification.

In 2021, we were particularly active in bringing new digital solutions to our clients. We achieved strategic milestones in our digital transformation roadmap, launching remote private individuals onboarding and consumer lending.

We also firmly materialized our strong commitment in supporting sustainability transitions, structuring green financings worth half a billion EUR.

And with a ROE of 15.6%* and a progression of 37% of our net profit, we delivered an excellent financial performance.“ said François Bloch, CEO of BRD Groupe Société Générale.

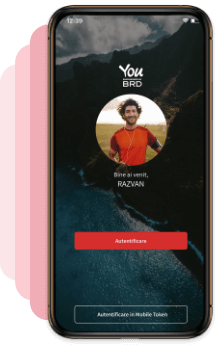

Widened digital offer, rapidly increasing adoption

Our new mobile application, YouBRD, has been constantly upgraded and enriched with new features for a simpler and enhanced experience. In addition, the digital offer to private individuals includes now two essential services: remote onboarding and online consumer lending.

Digital adoption is rapidly growing. The number of digitally active private individual customers is up by 20% YoY and 48% vs 2019, and the number of transactions is 31% higher than in 2020.

Corporate digital experience was also further enhanced with enriched cash management and trade finance solutions.

Intense commercial activity across the board

BRD Group net loans, including leasing receivables, recorded a double-digit growth (+11.2% compared to 2020).

Marked by the best yearly consumer loan production ever and a 66% progression of new housing loans, private individuals’ loan production strongly rebounded vs 2020 (+38%). It also registered a 17% increase versus 2019. Corporate lending (+26.3% compared to 2020) built on very strong dynamics on both SME (+22.8% YoY) and large corporate segments (+28.5% YoY).

Materializing its strong commitment to support sustainability transitions, BRD structured green financing worth 500m EUR, including the granting of the most important green loan on the Romanian market ever.

Retail savings grew by 7.8% YoY. The saving base is also increasingly diversified. BRD Asset Management reached first place on the market by number of investors and drove its market share to 19.5%***. Besides, BRD intermediated more than half of the 2021 Romanian government bond issuances for individuals within Fidelis program.

High profitability and strong balance sheet

BRD Group full year revenues reached RON 3,118 million, higher by 1.0% compared to 2020. Customer activity intensified on a yearly basis, translating into a solid growth of net fee and commission income, +7.5% y/y. Despite lower market rates during most of 2021, net interest income remained stable, underpinned by growing volumes.

Efficiency initiatives (automations, network of branches resizing) were accelerated and translated in lower staff costs. Other costs evolution (+4% y/y, excluding the cumulated contribution to deposit guarantee and resolution funds) notably mirrors the stepping up investments in digital transformation. Operating expenses were overall contained, with a 1.9% increase compared to 2020. Gross operating income remained consequently stable at RON 1,500 million.

The quality of the loan book was confirmed throughout 2021 as shown by the low NPL ratio (3.1% at year end), the high coverage with provisions of non performing exposures (75%) and cost of risk net write-backs.

Given all the above, net profit was up by 37% compared to 2020 and ROE reached 15.6%*.

BRD capital position is solid with total capital ratio reaching 22.9% (individual level) at December 2021, excluding 2021 net result, and deducting the exceptional dividend distribution from 2019 and 2020 retained profits proposed for AGM approval on February 24, 2022 (RON 1.68 bn).

Considering the results of the year as well as the expected capital trajectory, BRD Board of Directors decided to propose a dividend distribution rate of 70% out of 2021 distributable profit (1.285 RON /share), subject to a favorable vote by the Annual General Meeting of Shareholders on April 28, 2022.

Sustainability at the heart of BRD strategy

Taking a leadership role and acting as a pioneer in financing sustainability transitions, BRD structured green deals worth half a billion EUR in 2021.

At the same time, BRD continued its investments in essential areas for the future of Romanian society: education, science &technology, culture, sport, environment. The total amount invested in 2021 in projects for the society exceeded RON 8 million.

In the cultural area, BRD supports classical music and contemporary art through Foundation9, Scena9 arts & society magazine or its own cultural center in Bucharest, Rezidenta9. More than 200 events were sponsored or organized and over 300 artists, journalists, creators of culture were involved in 2021.

One of important causes BRD is engaged for is the transformation of the education and the reduction of illiteracy. BRD is an ambassador for this cause and supported more than 30 000 children all over the country through Alfabetar program.

Combating illiteracy is tremendously important, but also is investing in skills for the future. After 5 years and over EUR 1m investments, BRD First Tech Challenge robotics program is now present in over 20% of Romanian high schools.

BRD has also been a long lasting partner of Romanian sports, with focus on handball.

BRD continued to be involved in causes related to Romanian forests and through BRD Forest Fund over 38,000 trees were planted in Iasi County.

In their turn, BRD employees are encouraged to get involved in various causes. 1250 employees were involved in volunteering actions last year, all over the country, through ZiuaV volunteering platform.

BRD preliminary financial results for the year ended December 31, 2021 are available to the public and investors on the website of the bank: www.brd.ro beginning with 09h00. Copies of the documents can also be obtained upon request, free of charge, at the head office of BRD-Groupe Société Générale, located at 1-7, Ion Mihalache Bd., 1st district, Bucharest.

(*) ROE based on equity adjusted with exceptional distribution (from the retained profits of 2019 and 2020)

(**) Subject to a favorable vote by the Annual General Meeting of Shareholders on April 28, 2022

(***) Market share on open-end mutual funds market

Note: If not stated otherwise, all variations are vs. 2020 (for income statement related items) or December 2020 end (for balance sheet related items).

NPL ratio, Coverage ratio, at Bank level

Related articles:

BRD GROUP RESULTS FOR q1 2024: DYNAMIC performance across the board AND STRONG ENGAGEMENT to ACCE...

Important changes to the products and services offered by BRD

Continuing the strategy of simplifying the offer for individuals and at the same time digitalizing t...

BRD AND IFC JOIN FORCES WITH INAUGURAL TRANSACTION TO BOOST SUSTAINABLE FINANCE IN ROMANIA

Press release Bucharest, April 4, 2024 • Innovative synthetic significant ...

BRD Group

© 2024 BRD. This site is property of BRD. All rights reserved.

BRD Group

© 2024 BRD. This site is property of BRD. All rights reserved. Terms and conditions Sitemap

We would like to remind you that BRD - Groupe Societe Generale has not requested and will never ask any of your authentication data (user code, password or password token) or confidential information related to your card (card number, expiration date, security code or PIN) by phone, nor e-mail or SMS.

These confidential data will be used only for the internet banking authentication or for online payments.

At the same time, if you notice a different appearance of the usual MyBRD Net application (ex. A notification message that the page is unavailable and you are invited to log in again, or to sync your token device), please stop the authentication process immediately and contact as soon as possible through MyBRD Contact tel: 021 302 6161.

Always with you,

Your bank. Your team