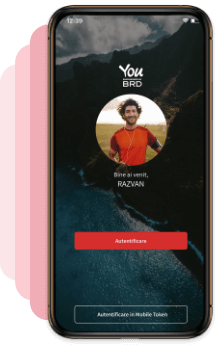

Asigură-te

că ai instalat

deja

aplicația de

mobile

banking

On 14.11.2024, between 22:00 and 00:00, maintenance operations will be carried out on the BRD IT systems. The remote banking applications will have moments of unavailability or will work intermittently. Certain functionalities will not be available during this period. We apologize for the inconvenience.

×Online trading

Other services

News

News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Scene 9

is an online cultural publication that shapes the portrait of the new generation of creators

Scoala 9

is an editorial project dedicated to the pre-university education created by DoR and BRD

Our team

Subsidiaries and associated entities

Culture

We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Education

We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Sports

We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Environment

Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

The Civil Society

Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Financial Information

Depository services

Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Issuer services

Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Global and local custody services

Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Clearing services

Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Contact

Discover

Learn

Apply

Saving and investments

Saving and investments

Offers

SMS banking

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Useful

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Find out more »Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Find out more »Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Find out more »Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Find out more »Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Find out more »News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Find out more »is an online cultural publication that shapes the portrait of the new generation of creators

Find out more »is an editorial project dedicated to the pre-university education created by DoR and BRD

Find out more »Find here our mass media contacts

Find out more »We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Find out more »We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Find out more »We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Find out more »Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

Find out more »Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Find out more »

01

Choose the one that suits you best

You can opt for variable or fixed interest throughout the loan period, or for fixed interest in the first 3 years of lending and then variable.

Calculate the rate HERE.

02

Pre-approval

loan

if you have not found the property you want, you can obtain pre-approval of the loan, valid for 90 days based on your income documents.

03

Find your

perfect home

You can use the guarantee account to pay the advance of the pre-contract (Escrow account). This ensures that you can recover your advance without any problems if necessary.

04

Final approval

After finding the building, you bring the property documents to the bank for the assessment of the building and obtaining the legal opinion. If all is well, you receive the final approval of the loan.

05

Contract signing

After finding the building, you bring the property documents to the bank for the assessment of the building and obtaining the legal opinion. If all is well, you receive the final approval of the loan.

Advantageous interest rates

If you bring a down payment of at least 20% and the property's performance class is A. Interest rates adapted to your needs: you can choose between a fixed interest rate for 3 years from 4.90%, subsequently variable IRCC+2.29%; variable interest for the entire period from IRCC+2.25% or fixed interest for the entire credit period from 7.99%.

Financial approval

you benefit from a 90-day financial pre-approval, so you have time to find the right home.

Free evaluation

you benefit from the free real estate appraisal, when the appraisal is performed by a bank-approved appraiser.

Additional amount

You can access an additional amount of maximum 20% of the value of the loan, to cover some expenses related to the real estate investment (notarial expenses, the valuation, the modernization of the house purchased from the loan).

Minimum down payment 15%

If you are buying your first home, a down payment of at least 20% brings you better interest rates

The Habitat loan is a mortgage-real estate loan for the purchase, construction, renovation, modernization of the building, guaranteed with a real estate mortgage.

You are safe throughout the entire loan period by completing life insurance that gives you and your family protection in the event of unforeseen events (total and permanent disability due to accident or death due to any cause). The policy is compulsory and ends when the loan agreement is signed, for the entire loan period.

In addition, it is necessary to conclude a home insurance policy/policies for collateral/collaterals. This insurance can be issued with BRD Asigurari Generale or other Insurer, depends of your options.

BRD Asigurari Generale offers to the clients various types of home insurances:

-Mandatory home insurance (PAD)

-Optional home insurance (fire and other calamities)

Additional, clients who contract optional insurance can attach 2 new types of insurances:

-Additional insurance for goods inside the house

-Civil liability

| PID document home insurance-assets | download |

| PID document home insurance-civil liability | download |

| PID document home insurance | download |

| LID document life insurance | download |

HOME. THE PLACE IN WHICH YOU CAN BE WHO YOU WANT TO BE, ANY TIME.

Write us and we will get in touch for all the details you need!

Representative example valid on 01.11.2024, calculated for the financing of a home through a Habitat loan, for which the property brought as a guarantee has a class A energy performance certificate, in the amount of 264,000 Lei, granted with a minimum 20% advance, on 30 years and repaid in 360 equal monthly installments, with the collection of the income in the BRD account: fixed interest of 4.90%/year in the first 3 years and then variable 2.29% + IRCC*, DAE 8.06%, the value of the first monthly payment amount 1,488.24 lei, the total amount payable: 702.410,86 lei (may decrease as a result of advance repayments), which includes a file analysis fee 650 lei, a monthly administration fee for the current account associated with the loan zero lei (cost valid on the period of holding a package of products and services), mandatory life insurance 0.033% per month charged to the credit balance (if you opt for the insurance distributed by BRD, as an affiliated agent of BRD Life Insurance Insurer). The cost of appraising the mortgaged property is zero lei if the appraiser is appointed by the bank. Property insurance (compulsory) depends on its value. The loan is secured by real estate mortgage. If the income is not collected in the BRD account, the interest becomes 5.16% fixed interest in the first 3 years from the granting of the loan and 2.54% + IRCC thereafter, and if you renounce the package of products and services, the administration fee monthly current account becomes 8 lei. Details on product and service packages can be found on brd.ro/en/individuals/cards-and-accounts/daily-banking/services-packages.

The annual interest is composed of the margin + IRCC. IRCC valid from 01.10.2024 to 31.12.2024 is 5.99%.

Before making the decision to borrow, analyze the characteristics and implications of the loan. Make sure you understand the risks associated with credit agreements, mainly regarding the fluctuation of your income, the variation of benchmarks in the case of loans with variable interest or the currency risk, if the income obtained is in a currency other than that of the loan . The consequences of non-repayment can be reporting to the Credit Bureau and the Credit Risk Center, as well as the initiation of recovery procedures.

© 2024 BRD. This site is property of BRD. All rights reserved.

© 2024 BRD. This site is property of BRD. All rights reserved. Terms and conditions Sitemap

We would like to remind you that BRD - Groupe Societe Generale has not requested and will never ask any of your authentication data (user code, password or password token) or confidential information related to your card (card number, expiration date, security code or PIN) by phone, nor e-mail or SMS.

These confidential data will be used only for the internet banking authentication or for online payments.

At the same time, if you notice a different appearance of the usual MyBRD Net application (ex. A notification message that the page is unavailable and you are invited to log in again, or to sync your token device), please stop the authentication process immediately and contact as soon as possible through MyBRD Contact tel: 021 302 6161.

Always with you,

Your bank. Your team