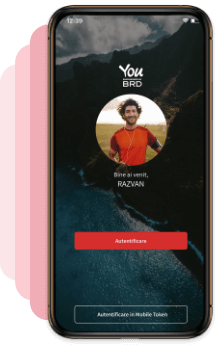

Asigură-te

că ai instalat

deja

aplicația de

mobile

banking

On 17.07.2024, between 22:00 and 00:00, maintenance work will be carried out on Apple Pay services. During this interval, card enrollment in this platform will not be available. Thank you for understanding.

×Online trading

Other services

News

News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Scene 9

is an online cultural publication that shapes the portrait of the new generation of creators

Scoala 9

is an editorial project dedicated to the pre-university education created by DoR and BRD

Our team

Subsidiaries and associated entities

Culture

We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Education

We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Sports

We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Environment

Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

The Civil Society

Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Financial Information

Depository services

Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Issuer services

Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Global and local custody services

Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Clearing services

Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Contact

Discover

Learn

Apply

Saving and investments

Saving and investments

Offers

SMS banking

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Useful

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Find out more »Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Find out more »Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Find out more »Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Find out more »Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Find out more »News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Find out more »is an online cultural publication that shapes the portrait of the new generation of creators

Find out more »is an editorial project dedicated to the pre-university education created by DoR and BRD

Find out more »Find here our mass media contacts

Find out more »We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Find out more »We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Find out more »We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Find out more »Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

Find out more »Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Find out more »06 May 2014

Related articles:

BRD GROUP RESULTS FOR q1 2024: DYNAMIC performance across the board AND STRONG ENGAGEMENT to ACCE...

Important changes to the products and services offered by BRD

Continuing the strategy of simplifying the offer for individuals and at the same time digitalizing t...

BRD AND IFC JOIN FORCES WITH INAUGURAL TRANSACTION TO BOOST SUSTAINABLE FINANCE IN ROMANIA

Press release Bucharest, April 4, 2024 • Innovative synthetic significant ...

© 2024 BRD. This site is property of BRD. All rights reserved.

© 2024 BRD. This site is property of BRD. All rights reserved. Terms and conditions Sitemap

We would like to remind you that BRD - Groupe Societe Generale has not requested and will never ask any of your authentication data (user code, password or password token) or confidential information related to your card (card number, expiration date, security code or PIN) by phone, nor e-mail or SMS.

These confidential data will be used only for the internet banking authentication or for online payments.

At the same time, if you notice a different appearance of the usual MyBRD Net application (ex. A notification message that the page is unavailable and you are invited to log in again, or to sync your token device), please stop the authentication process immediately and contact as soon as possible through MyBRD Contact tel: 021 302 6161.

Always with you,

Your bank. Your team